What is AML compliance in the crypto industry?

AML compliance in crypto refers to the set of regulations, procedures, and technologies that businesses must follow to prevent money laundering, terrorist financing, and financial crime. It ensures legal operation and builds trust with regulators, banks, and partners.

Why are AML regulations critical for cryptocurrency businesses?

AML regulations are designed to protect the financial system. For crypto companies, following them reduces the risk of fines, loss of licenses, frozen assets, or being cut off from banking services.

What are the global AML regulations for digital assets?

The Financial Action Task Force (FATF) sets global recommendations, while jurisdictions such as the EU (MiCA, AMLD), the US (FinCEN, SEC), and Asia apply their own frameworks. Compliance requires adapting to both global standards and local rules.

Who is required to implement AML compliance in crypto?

Exchanges, custodial wallets, OTC desks, brokers, NFT and DeFi platforms, and any virtual asset service provider (VASP) that processes transactions or holds customer assets are expected to comply.

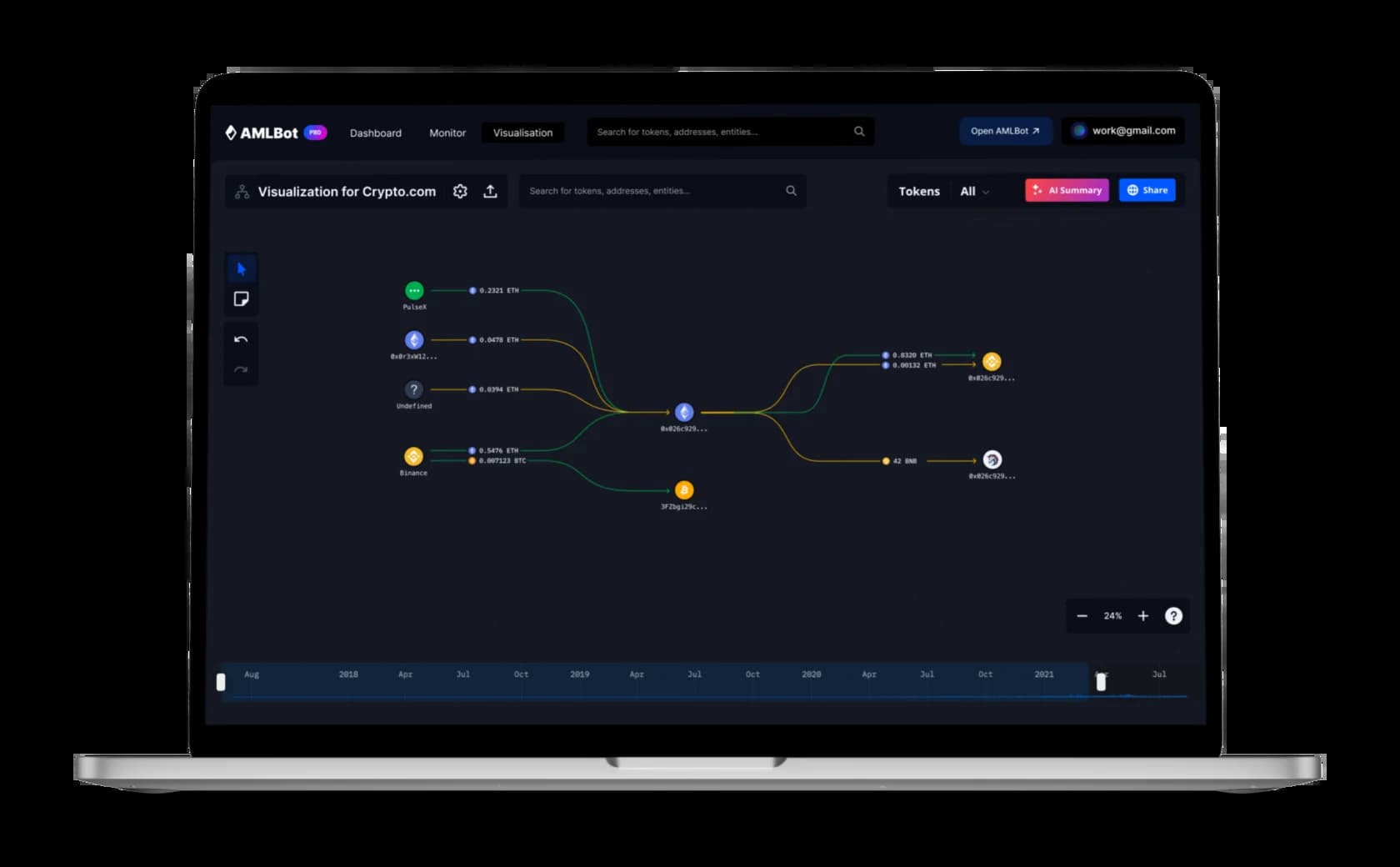

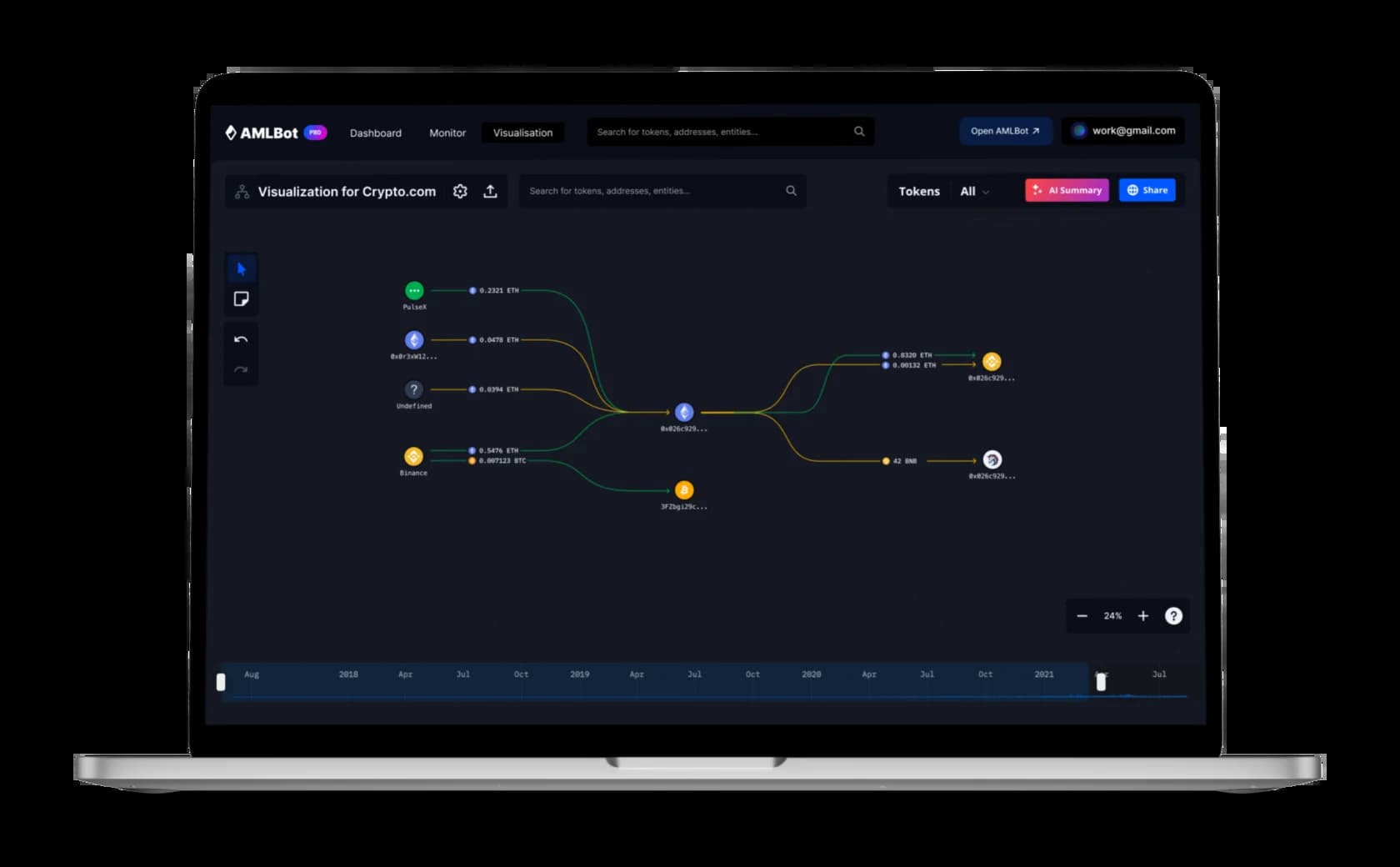

What is an AML check for cryptocurrency wallets and transactions?

An AML check is a detailed risk analysis of wallets and transactions using AMLBot algorithms, which includes:

Risk score – a percentage showing the likelihood of links to illicit activity (darknet, sanctions, scams, etc.).

Risk sources – categories such as mixers, fraud, stolen funds, sanctions or darknet markets.

Connection analysis – reviewing the wallet’s transaction history and links with other addresses.

Transaction perspective – for incoming payments the sender’s address is analyzed, for outgoing payments the recipient’s address.

AMLBot provides instant checks with global coverage, helping companies identify risks in real time and avoid suspicious transactions.

What are the key requirements for crypto AML compliance?

Requirements typically include customer due diligence (KYC/KYB), transaction monitoring (KYT), risk assessment, record-keeping, suspicious activity reporting, and ongoing audits. Many businesses rely on solutions like AMLBot to automate these steps and stay audit-ready.

How can a crypto business achieve AML compliance efficiently?

Most companies use automated AML compliance solutions to screen wallets, monitor transactions, and generate reports. AMLBot delivers these capabilities in line with FATF standards, reducing manual effort and helping companies scale securely.

What is the difference between KYC, KYB, and KYT in compliance?

KYC (Know Your Customer) verifies individuals, KYB (Know Your Business) validates companies, and KYT (Know Your Transaction) analyzes the flow of funds. Together they form the foundation of crypto AML compliance.

What are the risks of non-compliance with AML regulations in crypto?

Non-compliance can result in regulatory penalties, blocked transactions, frozen accounts, reputational damage, and even criminal liability.

How do AML compliance solutions help with international regulations?

They align processes with FATF guidelines and local rules, provide real-time transaction monitoring, and deliver documentation required for regulators, partners, and auditors.

Can AML compliance tools help prevent fraud and scams in crypto?

Yes. By flagging suspicious addresses, detecting high-risk patterns, and screening counterparties, compliance tools reduce fraud and scam exposure. AMLBot’s monitoring helps businesses avoid transactions linked to hacks, darknet markets, or sanctioned entities.

How do I start building an AML compliance program for my crypto company?

Begin with a risk assessment, establish AML policies, integrate screening and monitoring tools, train your team, and document everything for future audits.

INATBA

INATBA CDA

CDA ATII

ATII LSW3

LSW3 EBA

EBA FTAHK

FTAHK