What do we analyze?

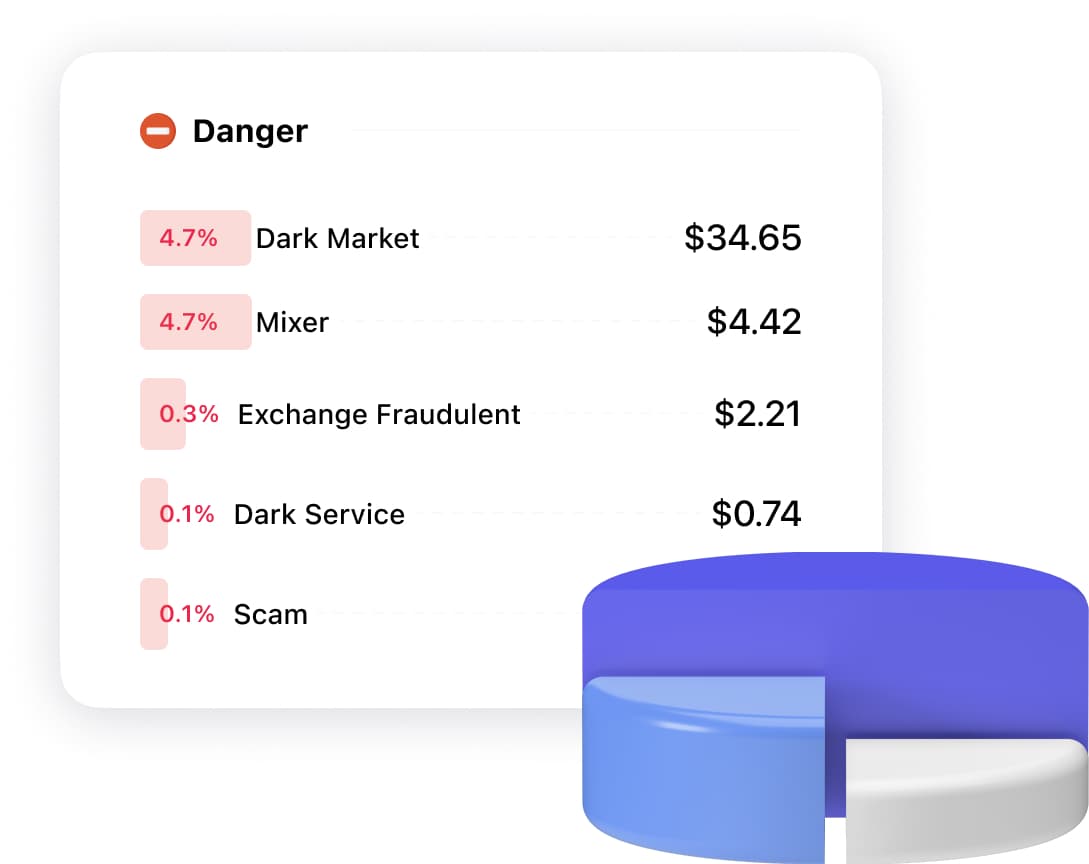

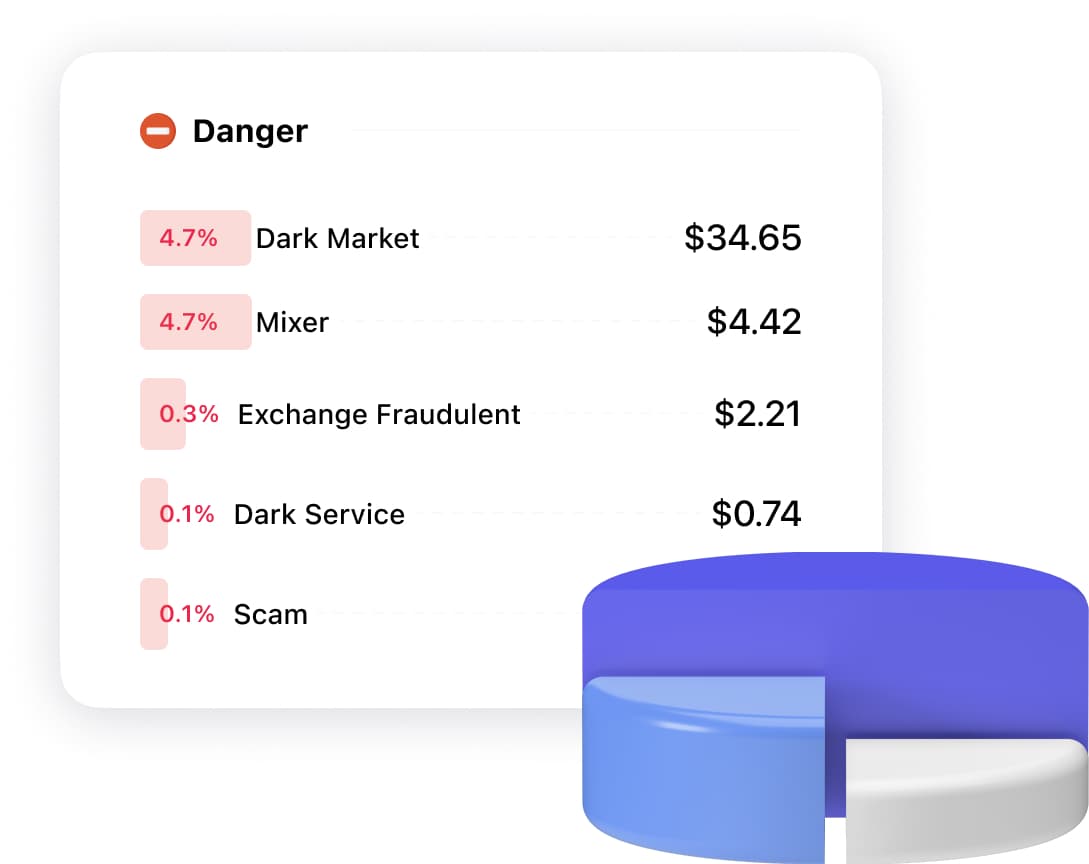

We analyze addresses for belonging to more than 20 sources of risk to find suspicious transactions and determine the risk factor. We divided all sources into three categories.

We analyze addresses for belonging to more than 20 sources of risk to find suspicious transactions and determine the risk factor. We divided all sources into three categories.

Entities associated with child exploitation.

Coins associated with illegal activities.

Coins related to child abuse, terrorist financing or drug trafficking.

The entity is subject to legal proceedings with the judicial authorities.

Exchanges involved in exit scams, illegal behavior, or whose funds have been confiscated by government authorities.

Coins associated with unlicensed online games

Coins associated with illegal activities.

Coins that passed via a mixer to make tracking difficult or impossible. Mixers are mainly used for money laundering.

Coins obtained by extortion or blackmail.

Entities subject to sanctions.

Coins that were obtained by deception.

Coins obtained by stealing someone else's cryptocurrency.

Entities associated with terrorism financing.

Coins obtained via cryptocurrency ATM operator.

An entity becomes high-risk based on the following criteria:

No KYC: does not require any customer information before allowing any level of deposit/withdrawal, or makes no attempt to verify that information.

Criminal Ties: Criminal charges against the legal entity in connection with AML/CFT violations.

Impact: High exposure to risky services such as darknet markets, other high-risk exchanges, or mixing is defined as a service whose direct high-risk exposure differs by one standard deviation from the average of all identified exchanges over a 12-month period.

Jurisdiction: based in a jurisdiction with weak AML/CFT measures.

Unlicensed: does not have any specific license to trade cryptocurrencies.

The smart contracts where tokens are locked for the purpose of providing liquidity.

The entity does not have any special license to conduct and provide cryptocurrency exchange services, when participants exchange directly with each other, without intermediaries.

It also includes entities that are licensed but located in listed jurisdictions, are listed as non-cooperating companies by the FATF, or do not provide KYC for large-value transactions, making them attractive for money laundering.

The category refers to currently unidentified clusters that exhibit the behavior expected of a service, by a large number of addresses and transactions.

The organization allows users to buy, sell and trade cryptocurrencies with trading licenses that include the following aspects of services:

—Depository, brokerage or other related financial services that provide exchange services where participants interact with a central party.

And it does not include:

— Licenses for non-specific financial services and jurisdictions included in the FATF non-cooperative list.

They represent the most important and most used category of entities in the cryptocurrency industry, accounting for 90% of all funds sent via these services.

The organization that crowdfunds its project by selling their newly minted cryptocurrency to investors in exchange for fiat currency or more common cryptocurrencies such as Bitcoin and Ether.

There are many legitimate examples of these offerings, but also there are many cases where bad actors raise funds via ICOs, then they take the money and disappear.

Coins that were used to pay for legal activities

The entity that allows businesses to accept payments from their customers, also known as payment gateways or payment processors.

It often faciliates conversions to local fiat currency and transferring the funds into the merchant's bank account.

Coins mined by miners and not forwarded yet.

Coins obtained through airdrops, token sales or other means.

The entity is licensed to conduct a business that is specific to providing cryptocurrency exchange services where participants exchange directly with each other, without intermediaries.

It does not include non-specific financial services licenses and jurisdictions that are on the non-cooperative FATF list.

Coins related to payment services.

Crypto assets seized by the government.

Online Wallet is a service used for storing and transacting cryptocurrency. Hosted wallets, a type of online wallet, are custodial solutions where the service holds the user's private keys, posing potential risks of scams or insufficient security, though reputable providers may offer better security than non-expert individuals.